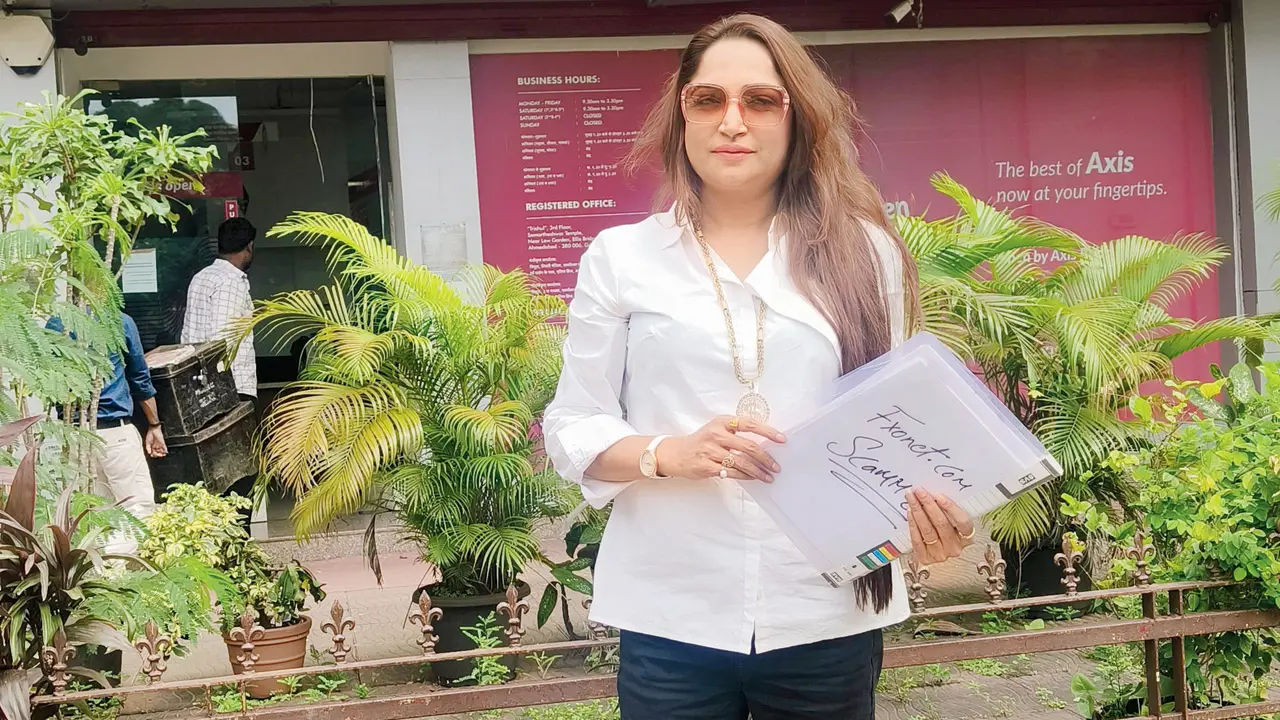

Shabnam Shaikh, a 39-year-old Bandra West resident who lost Rs 23 lakh in an online trading scam, has recovered nearly Rs 12.25 lakh with the help of her bank. Shaikh filed a chargeback form at Axis Bank’s Sion branch, after which the bank froze the fraudsters’ account and managed to recover part of the money.

This newspaper, in its May 26 edition, had shed light on how Shaikh, who resides at Pali Hill and runs an NGO, had invested about Rs 23 lakh in the online trading app of the FXonet website.

Shaikh told the police that she came to learn of the platform via X on April 25, and she deemed it trustworthy as it featured photographs of a prominent Bollywood actress and a well-known singer, creating the impression that they endorsed the website.

Victim’s plight

Recounting her ordeal, Shaikh told mid-day, “I was helpless after being trapped by a fake online trading application. I invested almost Rs 23 lakh, and the app kept showing that I had earned a lot of money, but I couldn’t withdraw anything. I sent many emails to FXonet but got no help. Finally, I registered an FIR at the cyber police station in Bandra Kurla Complex. Even after that, I didn’t receive any help from the police.”

She added, “A friend told me about the chargeback option. I filled out the form online with the bank’s help. The bank investigated the matter and confirmed that fraud had occurred. So far, I’ve received Rs 12.25 lakh back. The bank is reversing my money in phases. In five different transactions, the same amounts I had invested are being credited back to my account.”

Shaikh also alleged, “The fraudsters threatened me via email. They told me to get the mid-day report taken down and delete all my tweets. They even offered to settle the matter for 8000 dollars if I agreed to withdraw the FIR, but I refused. I trust the banking system and believe I will get all my money back. If the police won’t help, I will track these criminals myself.”

Pares Kumar Paikaray, operations head at Axis Bank’s Sion branch, stated that it is mandatory to file an FIR to submit a chargeback form at the bank in cases of fraudulent transactions. “Our account holder, Shaikh, lost Rs 23 lakh on an online trading app and reported this to us. She lost the money in April and registered the FIR. On June 8, we raised the issue with the bank where the money was transferred. An investigation team confirmed it was a fraudulent transaction, and part of the money was returned.”

What is the chargeback process?

This is a form of consumer protection that allows bank account holders to dispute a transaction they believe is fraudulent, unauthorised, or not as described, according to Razorpay.com. The account holder must request their bank to reverse the transaction as soon as they possibly can.

The road to recovery

File FIR

The step is mandatory in cyber fraud cases

Submit chargeback form

Ask your bank for a chargeback request form

Attach a copy of the FIR and mention details of the fraud with proof

Bank investigates

The bank verifies and cross-checks the recipient’s account

The fraud is confirmed

Freeze and reverse

The bank freezes the fraudsters’ account

Transactions are reversed in phases, in the exact order they occurred

Shaikh’s money recovery timeline

May 20 Rs 1,63,452.85

July 6 Rs 81,779.41

July 6 Rs 20,448.52

July 6 Rs 18,972.83

July 6 Rs 1,20,052.17

July 6 Rs 64,523.53

July 6 Rs 1,63,558.81

August 4 Rs 3,43,282.81

August 20 Rs 2,49,082.91

Rs 12.25 Lakh

Amount returned to Shaikh so far